rhode island income tax rate 2021

The rhode island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2021. Guide to tax break on pension401kannuity income.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

No Tax Knowledge Needed.

. RI-1040NR Nonresident Individual Income Tax Return wwwtaxrigov 2 0 2 1 Nonresident Real Estate Withholding. Increased Federal AGI amounts for the social security the pension and annuity modifications. Ad Compare Your 2022 Tax Bracket vs.

Line 6 - Apportioned Rhode Island Taxable Income Multiply your adjusted taxable income amount from line 4 times the Rhode Island Apportionment Ratio from line 5. It is the basis for preparing your Rhode Island income tax return. Explore data on rhode islands income tax sales tax gas tax property tax and business taxes.

Rhode Island Division of Taxation. If you were subject to backup withholding on the sale of real estate in Rhode Island be sure to list the amount of withholding paid on your behalf on line 17c. Complete your 2021 Federal Income Tax Return first.

Nonresidents and part-year residents will file their Rhode Island Individual Income Tax Returns using Form RI-1040NR. File With Confidence Today. If line 22a or 22b of Federal 1120S is applicable refer to Rhode Island Schedule S for your tax calculation.

Those under 65 who are not disabled do not qualify for the credit. Line 8a and 8b - Rhode Island Total TaxFee. Uniform tax rate schedule for tax year 2021 personal income tax Taxable income.

Tax Rate Schedule RI Tax Tables NEW FOR 2021. 3 rows 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA. 3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three.

The Rhode Island estate tax has rates that range from 08 up to 16. Start filing your tax return now. Uniform tax rate schedule for tax year 2021 personal income tax taxable income.

Directions Google Maps. The income tax is progressive tax with rates ranging from 375 up to 599. Over But not over Pay percent on excess of the amount over 0 66200 -- 375 0 66200 150550 248250 475 66200 150550 -- 648913 599 150550.

Subscribe for tax news. Line 7a - Minimum Tax Rhode Island minimum tax is 40000. Find your pretax deductions including 401K flexible account contributions.

Ad Answer Simple Questions About Your Life And We Do The Rest. Tax Rate 0. Any income over 150550 would be taxes at the highest rate of 599.

TAX DAY NOW MAY 17th - There are -311 days left until taxes are due. For income taxes in all fifty states see the income tax by state. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

For tax year 2021 the property tax relief credit amount increases to 415 from 400. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax.

Taxable income between 66200 and 150550 is taxed at 475 and taxable income higher than that. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Line 7a - Rhode Island Annual Fee Enter the amount of 40000 on this line.

Rhode Island has a flat corporate income tax rate of 7000 of gross income. Rhode Island Income Tax Calculator 2021 If you make 135500 a year living in the region of Rhode Island USA you will be taxed 28671. The first 66200 of Rhode Island taxable income is taxed at 375.

One Capitol Hill Providence RI 02908. Find your income exemptions. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. Pursuant to RIGL 44-11-2e the minimum tax imposed shall be 40000 Line 7b - Jobs Growth Tax Enter 5 of the aggregate performance-based compensation paid to eligible employees as per the Jobs Growth Act 42-6411-5.

In gen-eral the Rhode Island income tax is based on your federal adjusted gross income. For more information about the income tax in these states visit the Massachusetts and Rhode Island income tax pages. The ri use tax only applies to certain purchases.

Rhode Island has a progressive state income tax system meaning residents who earn more may pay a higher rate. Your 2021 Tax Bracket to See Whats Been Adjusted. Find your gross income.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. TurboTax Makes It Easy To Get Your Taxes Done Right. RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income.

Specifically the Rhode Island estate tax has an exemption of 1595156 for those who die in 2021 and 1648611 for anyone who dies in 2022. Discover Helpful Information and Resources on Taxes From AARP. There are three tax brackets and they are the same for all taxpayers regardless of filing status.

By contrast the federal exemption is 117 million for 2021 and 1206 million for 2022.

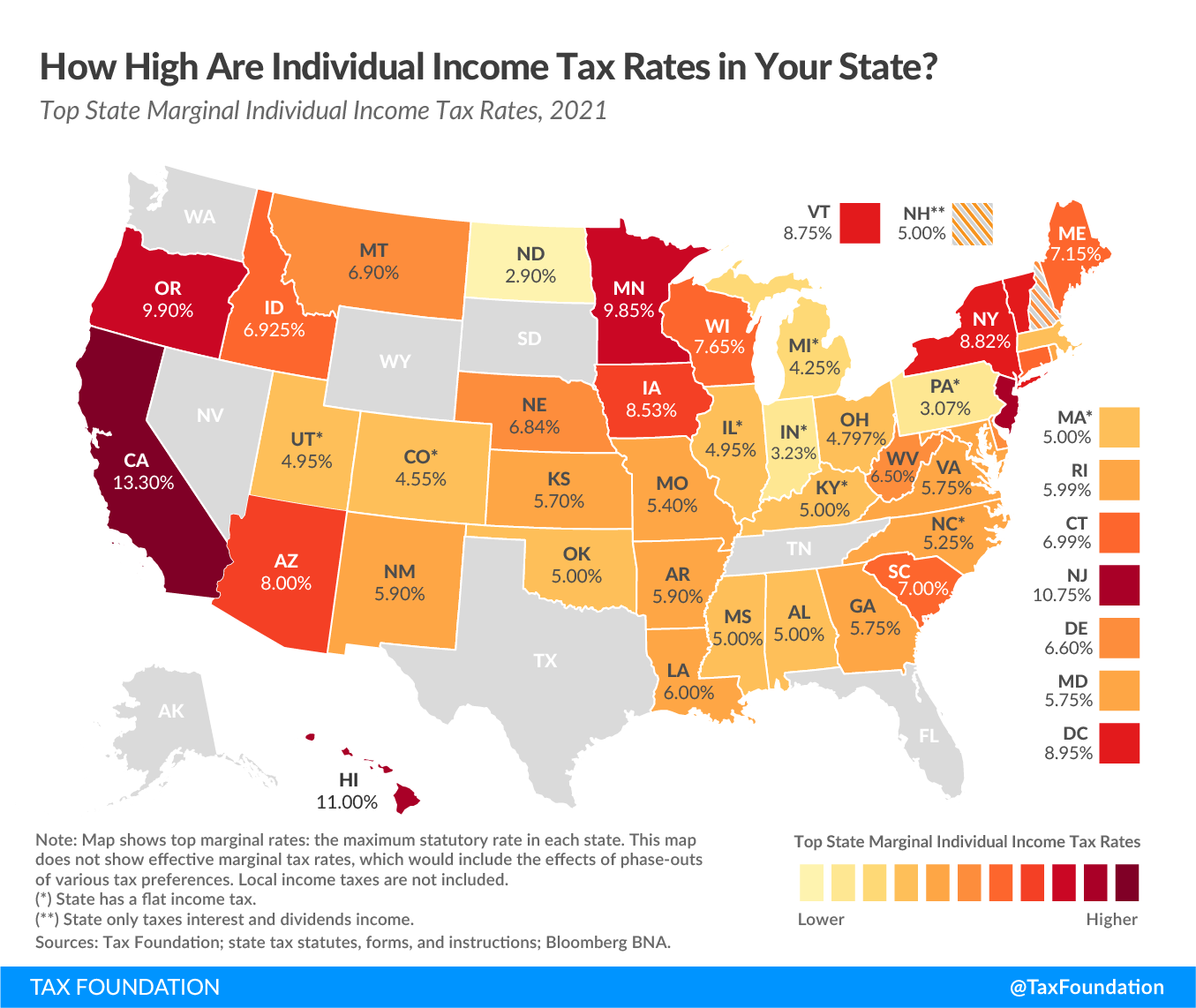

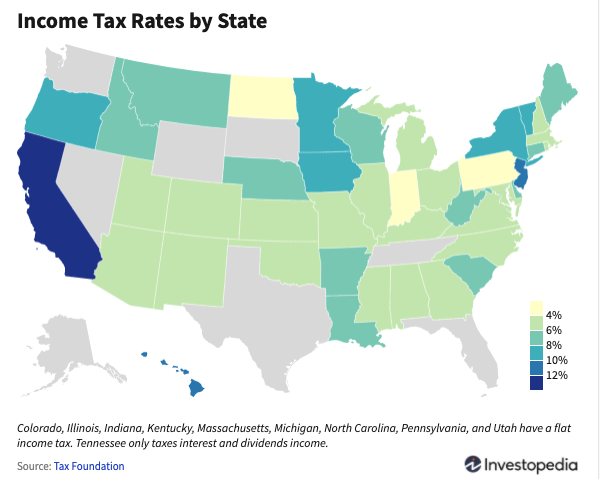

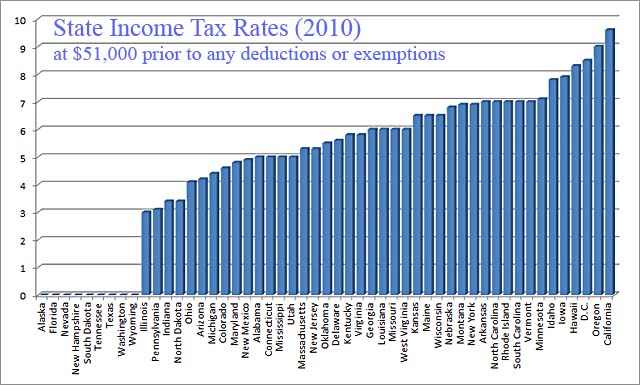

Monday Map Top State Income Tax Rates Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Calculator Smartasset

2021 Corporate Tax Charges And Brackets Tax News Daily

States With Highest And Lowest Sales Tax Rates

The Case For A Tax Swap Slow Boring

Individual Income Tax Structures In Selected States The Civic Federation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Income Tax Calculator 2021 2022 Estimate Return Refund

Qod Updated How Many States Do Not Have State Income Taxes Blog

How Is Tax Liability Calculated Common Tax Questions Answered

Michigan Income Tax Rate And Brackets 2019

2022 State Income Tax Rankings Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)