utah county sales tax on cars

If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption. Utah collects a 685 state sales tax rate on the purchase of all vehicles.

Used Ford Expedition For Sale In Salt Lake City Ut Cargurus

If you leased the vehicle see register a leased vehicle.

. Average Sales Tax With Local. State Local Option. In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles.

Utah State Sales Tax. Average Local State Sales Tax. Utah collects a 685 state sales tax rate on the purchase of all vehicles.

The December 2020 total local sales tax rate was also 7150. The state sales tax rate in Utah is 4850. All dealerships may also charge a dealer documentation fee.

In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles. 30000 x 0696 2088. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here.

In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. Some dealerships may also charge a dealer documentation fee of 149 dollars. Maximum Possible Sales Tax.

Sales Tax Rate s c l sr. You may take a credit for sales or use tax paid to another state but not a foreign country. This means that your sales tax is 2088 on a 30000 purchase price.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. On top of that youll also have to factor in the county or local sales tax for the dealership where youre buying. For example lets say that you want to purchase a new car for 30000 you would use the following formula to calculate the sales tax.

Revenue Summaries Formerly TC-23 2022. The Utah state sales tax rate is currently 485. The DMV calculates and collects the sales tax and issues a sales tax receipt.

Search Utah Sales Tax On Vehicles. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return. Maximum Local Sales Tax.

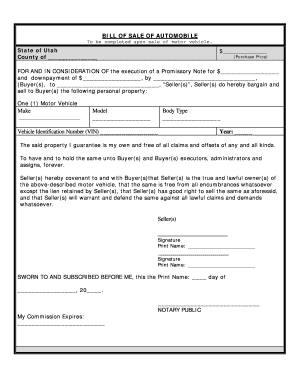

The Utah County sales tax rate is. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. For the buyer the bill of sale documents the purchase price of the vehicle for sales tax purposes.

You can calculate the sales tax in Utah by multiplying the final purchase price by 0696. 272 rows Utah Sales Tax. Used Motor Vehicle Sales.

For the seller a bill of sale provides proof that title to the vehicle has been legally transferred. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. The Utah County sales tax rate is.

It is important to write up a bill of sale when selling an automobile. The current total local sales tax rate in Utah County UT is 7150. Utahs statewide sales tax is 685 for new and used vehicle purchases.

New Motor Vehicle Sales. 19 feet or more in length but less than 23 feet in length. These are all no reserve auctions.

Summit County is the most expensive place in Utah for car sales taxbuying a car here comes with a sales tax rate of 905. 801 851-8255 County Holidays. Other Taxes Reports.

You can find these fees further down on the page. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Utah has state sales.

Combined rates in some of Utahs more popular car buying locations are as follows. The purchaser will pay the sales tax at the time the vehicle is titled and registered at the Utah Division of Motor Vehicles. In Salt Lake County for example the combined sales tax rate as of January 1 2022 is 725.

100 East Center Street Suite 1200 Provo Utah 84606 Phone Number. Just enter the five-digit zip code of the location in which the. All dealerships may also charge a dealer documentation fee.

The bill of sale should contain. By comparison Piute County collects a total of 61 of the purchase price. How to Calculate Utah Sales Tax on a Car.

All dealerships may also charge a dealer documentation fee. Ad Search Utah Sales Tax On Vehicles. Name and address of the buyer.

93 rows This page lists the various sales use tax rates effective throughout Utah. Ive bought private party vehicles. Get Results On Find Info.

If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40.

Utah Motor Vehicle Bill Of Sale Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Used Honda Cr V For Sale In Salt Lake City Ut Cargurus

Used Cars In Missouri For Sale Enterprise Car Sales

Utah S Public Transit System Went From Being Reviled To Celebrated In 2006 Voters Easily Approved A Quarter Cent Sales Tax Hike So Transit Map Utah Turn Ons

Used 2017 Jeep Grand Cherokee For Sale Near Me Edmunds

Fillable Form Vehicle Bill Of Sale Bills Things To Sell Types Of Sales

Used Cars In Utah For Sale Enterprise Car Sales

Utah Motor Vehicle Bill Of Sale Form Templates Fillable Printable Samples For Pdf Word Pdffiller

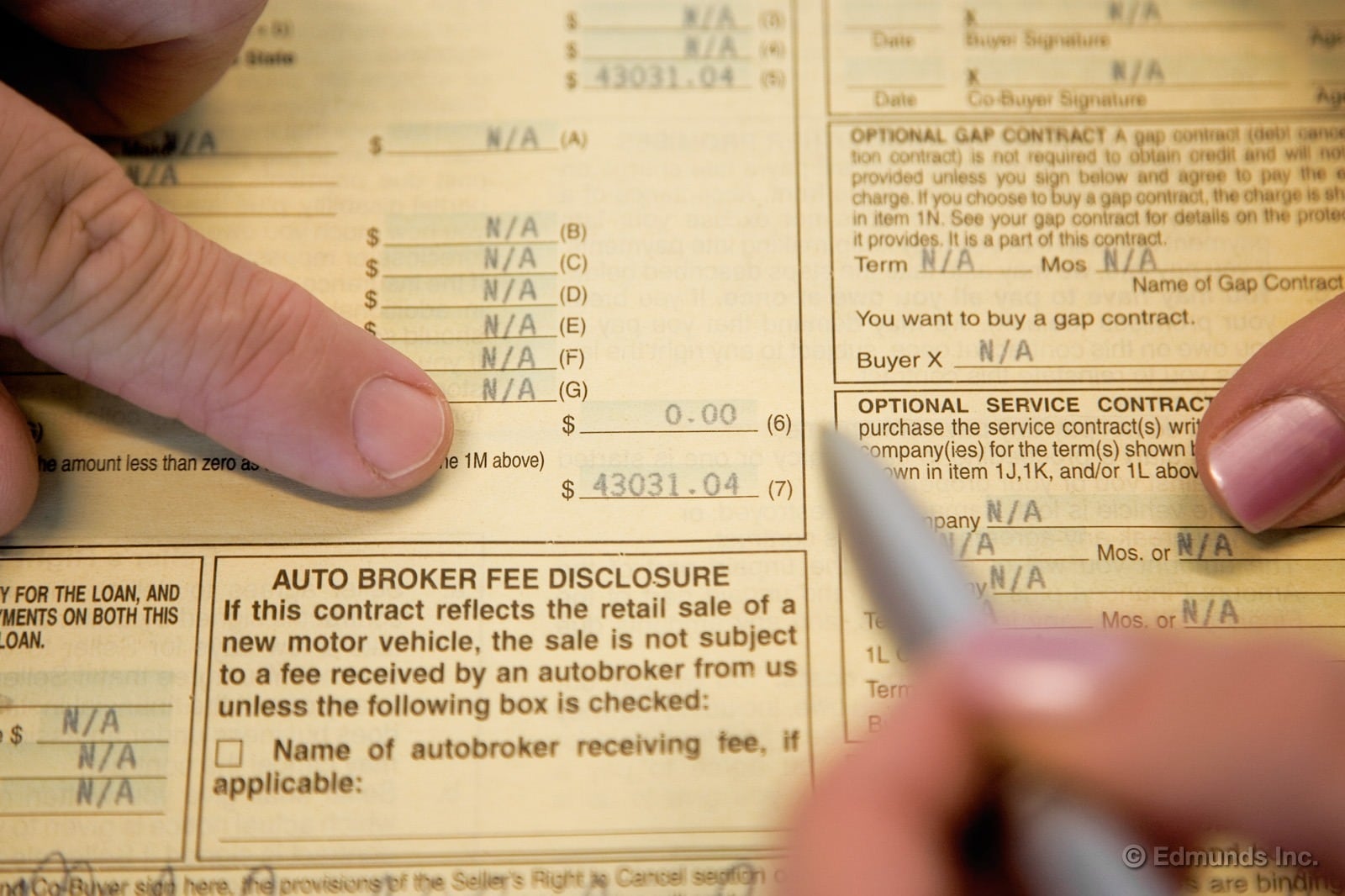

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Used Toyota Sienna For Sale In Orem Ut Brent Brown Toyota

Dmv Fees By State Usa Manual Car Registration Calculator

Treasure Hunting In Utah What S Behind The Thrill Of The Hunt And The Hide

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Utah Motor Vehicle Bill Of Sale Form Templates Fillable Printable Samples For Pdf Word Pdffiller